The world of accounting and banking is evolving, with MYOB shaking things up by introducing Solo Money transaction accounts and debit cards tailored for sole traders. This move blurs the lines between traditional accounting software and business banking, offering a seamless financial solution for small businesses.

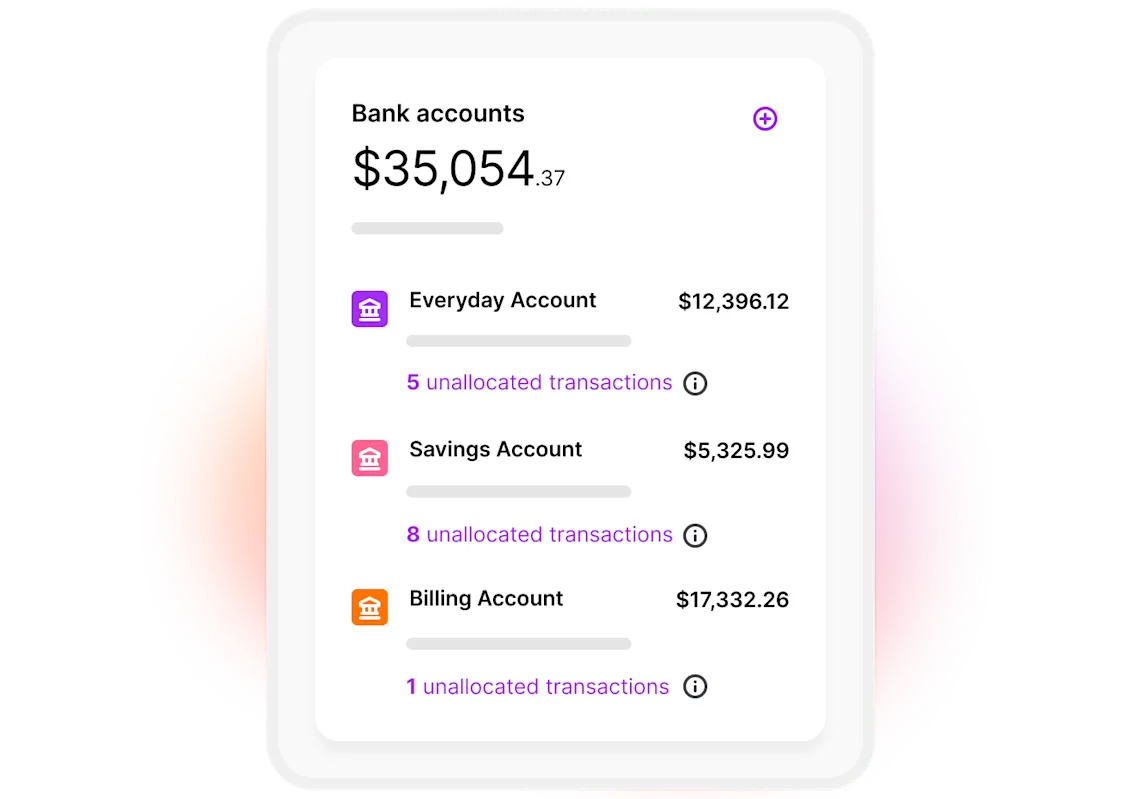

In a bid to streamline financial management for sole traders, MYOB’s Solo app now enables users to open dedicated bank accounts specifically designed to separate business expenses from personal finances. By integrating these bank account transactions with MYOB’s existing accounting software, the company aims to eliminate the hassles of double-handling data, providing a more efficient and integrated experience for users.

Great Southern Bank will be facilitating these banking services in collaboration with MYOB, leveraging its expertise in digital business banking solutions. Users will have access to Mastercard-branded debit cards associated with their Solo Money accounts, empowering them to manage their finances conveniently on-the-go.

MYOB CEO Paul Robson highlighted how this innovative system could benefit Australia’s 1.6 million non-employing businesses:

“Sole operators take a leap of faith when they start their own business…Finding ways to reduce complexity and provide cashflow transparency is critical in helping Australian startups start, survive and succeed.”

Solo was initially launched to cater to sole traders seeking an alternative that bridges the gap between basic spreadsheets and comprehensive accounting software. This latest development underscores MYOB’s commitment to enhancing financial management tools for small businesses across Australia.

The integration of payment acceptance features within accounting platforms is gaining momentum in the industry. Competitor Xero recently introduced tap-to-pay functionality aimed at enabling seamless payments through smartphones. While Xero allows users to connect their own bank accounts, MYOB stands out by offering its proprietary banking solution through Solo.

Additionally, companies like Zeller are also tapping into this trend by providing business transaction accounts and debit cards without a full-fledged accounting platform. The emergence of such integrated offerings reflects the growing convergence of accounting and payment systems tailored to meet the diverse needs of small businesses.

As fintech continues to reshape the landscape, traditional banks are ramping up efforts to cater specifically to small businesses. In response, MYOB is set to launch its Solo business accounts later this month, marking another milestone in empowering sole traders with efficient financial tools.

The evolution of MYOB’s Solo Money ecosystem exemplifies a shift towards holistic financial solutions that combine banking services with cutting-edge accounting technology. By offering dedicated bank accounts and debit cards within its platform, MYOB is not just simplifying financial management but also nurturing the growth of small businesses in today’s dynamic market landscape.

Leave feedback about this