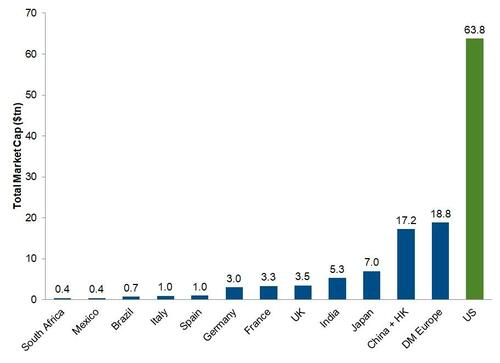

In a groundbreaking development, the U.S.

Stock Market has achieved a milestone by surpassing the combined market capitalization of major economies including Europe, China, Hong Kong, Japan, India, United Kingdom, France, Germany, Spain, Italy, Brazil, Mexico, and South Africa.

This remarkable feat highlights the dominance and strength of the American financial markets, showcasing a resurgence of what some have dubbed as American Exceptionalism..

The surge in the U.S.

Stock Market’s market cap signals a significant shift in global economic dynamics.

With the U.S.

economy demonstrating resilience and robust performance, investors are increasingly drawn to the stability and growth potential offered by American companies.

This achievement not only solidifies the U.S.’s position as a financial powerhouse but also underscores the attractiveness of American investments on the global stage..

The European markets, in comparison, have been grappling with economic uncertainties, geopolitical challenges, and regulatory issues.

While countries like Germany and France remain key players in the global economy, the collective market cap of European nations pales in comparison to the sheer magnitude of the U.S.

Stock Market’s valuation.

This stark contrast raises questions about the future trajectory of European economies and their ability to compete in the increasingly competitive global market..

Moving forward, the widening gap between the U.S.

Stock Market and its international counterparts could have profound implications for global investment trends, trade dynamics, and geopolitical influence.

As the U.S.

continues to assert its financial dominance, European countries may need to reassess their economic strategies and policies to remain competitive and attract investors.

The achievement of surpassing the combined market cap of major economies serves as a wake-up call for European leaders to bolster their economic resilience and attractiveness to investors in an ever-evolving global landscape..

Leave feedback about this