In a bustling city, under the warm glow of the sun, two significant entities came together to forge a partnership that could potentially reshape the economic landscape of West Africa. The Banque d’Investissement et de Développement de la CEDEAO (BIDC) and the African Trade and Investment Development Insurance (ATIDI) recently inked a protocol agreement aimed at bolstering their collaboration to support the private sector in the region.

The signing ceremony took place against the backdrop of the 2025 Annual Meetings of the African Development Bank Group in Abidjan. This landmark agreement establishes a broad framework for cooperation between BIDC and ATIDI with a primary goal—to mitigate risks associated with private transactions to attract more investments under competitive conditions.

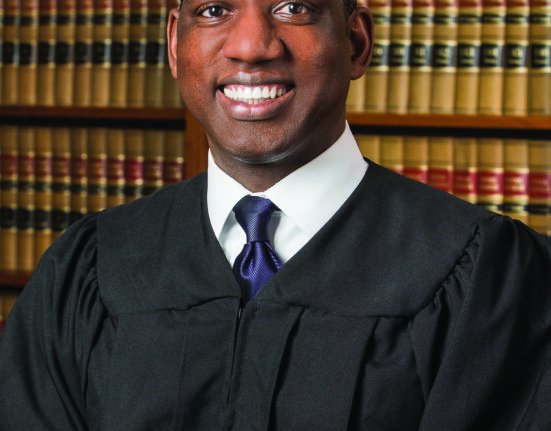

Dr. George Agyekum Donkor, President of BIDC, highlighted the crucial role of credit insurance in mobilizing finances under optimal terms. He commended certain ECOWAS member states like Benin, Côte d’Ivoire, and Cape Verde for their positive credit ratings that enhance investor confidence.

“Credit insurance is a strategic tool to alleviate the impact of macroeconomic and political challenges facing the region,”

Dr. Donkor emphasized.

He further underscored demographic shifts and urbanization as pivotal issues necessitating increased investments in infrastructure and energy sectors. These challenges call for innovative financial mechanisms to secure vital funding for development agendas.

On behalf of ATIDI, Manuel Moses expressed that this protocol signifies a significant step towards facilitating access to financing, particularly for small and medium-sized enterprises (SMEs) grappling with structural obstacles.

“This partnership underscores the importance of strategic collaboration between regional institutions to yield tangible impacts on economic development,”

Moses stated assuredly.

Established in 2001, ATIDI provides safeguards against political risks, non-payment scenarios, and contractual commitments. With an impressive track record of supporting transactions totaling $88 billion across Africa, ATIDI boasts an A/Stable rating from Standard & Poor’s and an A2/Positive rating from Moody’s—a testament to its financial stability.

Meanwhile, headquartered in Lomé, BIDC serves as ECOWAS’ premier development finance institution focusing on projects spanning infrastructure, industry, rural development, and essential social services through loans, equity investments,

credit lines,and refinancing mechanisms.

As these two powerhouse institutions join forces through this collaborative endeavor,focused on enhancing access to finance,supporting key economic sectors,and fostering a conducive environment for private investment,the stage is set for catalyzing sustainable growth across West Africa.

Leave feedback about this