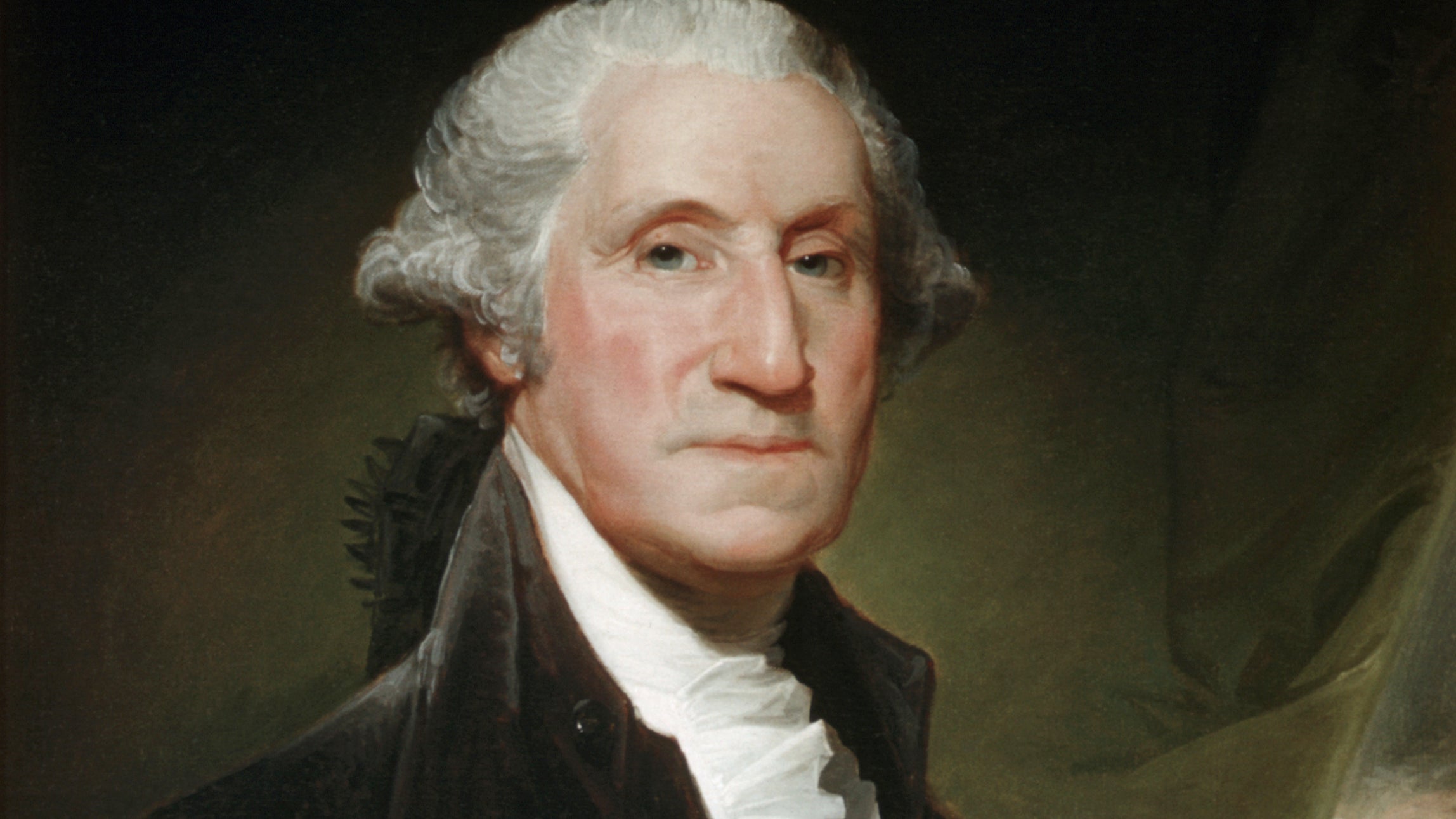

George Pyne, the chief executive officer of Bruin Capital, candidly expressed his views on the current financial landscape, stating,

“It’s one of the most challenging times to raise money.”

The impact of Trump’s tariffs has introduced a significant level of uncertainty into the market, leading to a slowdown in investment activities.

In a recent discussion at the SportsPro Investment Summit in London, Pyne highlighted the complexities faced by companies seeking capital infusion. He emphasized how economic uncertainties have caused investors to become more cautious and hesitant. Pyne remarked,

“All of those things are there because of the uncertainty. And when people are uncertain, they pull back.”

Established a decade ago with an initial investment of US$250 million from notable backers such as Dan Gilbert and Nassef Sawiris, Bruin Capital has since amassed over US$1 billion in committed capital. The firm’s strategic investments range from docuseries production to sports agencies and cutting-edge technologies like golf simulators.

Pyne shared insights into Bruin’s approach to investments, focusing on sports-adjacent businesses rather than direct team ownership. He hinted at potential expansions and stated optimistically,

“We will hopefully be acquiring more capital as we move forward.”

With evolving dynamics in sports finance, particularly regarding private equity involvement in major leagues like the NFL, Pyne offered his perspective on increasing franchise valuations. Reflecting on the NFL’s decision to allow private equity investments in teams—a move previously considered improbable—Pyne indicated that future changes might involve revisiting ownership limits and expanding investment opportunities within sports franchises.

Amid these transformations in sports finance, private equity firms are increasingly drawn to sport-related ventures due to their stable revenue streams and loyal fan bases. Pyne affirmed that investing in sports remains

“a really good and safe bet”

for financial stakeholders eyeing long-term growth prospects.

The surge in team valuations across different leagues underscores the attractiveness of sports assets for investors seeking diversification and sustainable returns. From NFL franchises reaching record valuations to women’s leagues witnessing unprecedented growth rates, the sports industry continues to allure savvy investors looking for resilient sectors amidst economic fluctuations.

Pyne acknowledged this trend but also underlined that while predictions about future valuations remain uncertain, one constant factor is sport’s unique ability to engage audiences amid a rapidly changing media landscape. He emphasized that unlike other forms of entertainment which can be easily replicated through technology advancements like artificial intelligence, sport retains its intrinsic value and emotional connection with fans.

In conclusion, George Pyne’s observations shed light on the intricate interplay between economic uncertainties driven by global factors like tariffs and evolving investment trends within the dynamic realm of professional sports. As financial landscapes continue to evolve, stakeholders navigate challenges while recognizing the enduring appeal and solid fundamentals underpinning investments in this ever-evolving sector.

Leave feedback about this