Digital assets exchange Coinbase (NASDAQ: COIN) has been making waves in 2025, enhancing its offerings and expanding its presence in the crypto world. Two recent developments stand out as significant milestones: the acquisition of LiquiFi, a leading token management platform, and the integration of PayPal as a payment option for Australian users.

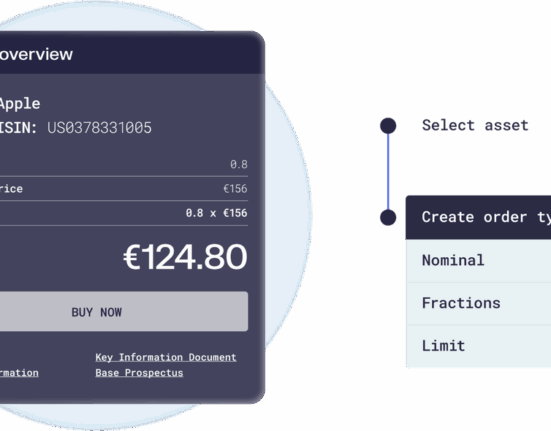

The move to acquire LiquiFi showcases Coinbase’s commitment to simplifying onchain development and improving user accessibility within the blockchain space. LiquiFi, established in 2021, is well-known for its tools that streamline token cap table management, vesting schedules, and compliance processes for early-stage blockchain projects. With clients like Uniswap Foundation, OP Labs (Optimism), Ethena, Zora, and 0x under its belt, LiquiFi manages billions in digital assets and facilitates transactions for hundreds of thousands of stakeholders across various crypto firms.

“This acquisition allows Coinbase to better support builders at an earlier stage by addressing legal, tax, and compliance challenges that often arise during token launches,”

highlighted Greg Tusar , Coinbase’s VP of Institutional Product. By integrating LiquiFi’s capabilities into Coinbase Prime, issuers will have access to top-notch tools for custody services, trading facilities, and financing options. This strategic move aligns with Coinbase’s vision of streamlining token launches to be as seamless and scalable as issuing traditional startup equity.

Moreover,

“LiquiFi’s platform not only benefits employees with user-friendly token compensation plans but also provides investors with simplified token management processes akin to handling equity investments,”

noted Tusar . By automating tasks such as creating custom vesting schedules or executing compliant airdrops globally while reducing administrative burdens associated with launch risks can enhance efficiency across the board.

The incorporation of Liquifi into its ecosystem marks Coinbase’s fourth acquisition in 2025 after deals like the $2.9 billion Deribit purchase—reflecting an industry-wide trend towards consolidation due to increasing demand for compliant token infrastructure.

On another front,

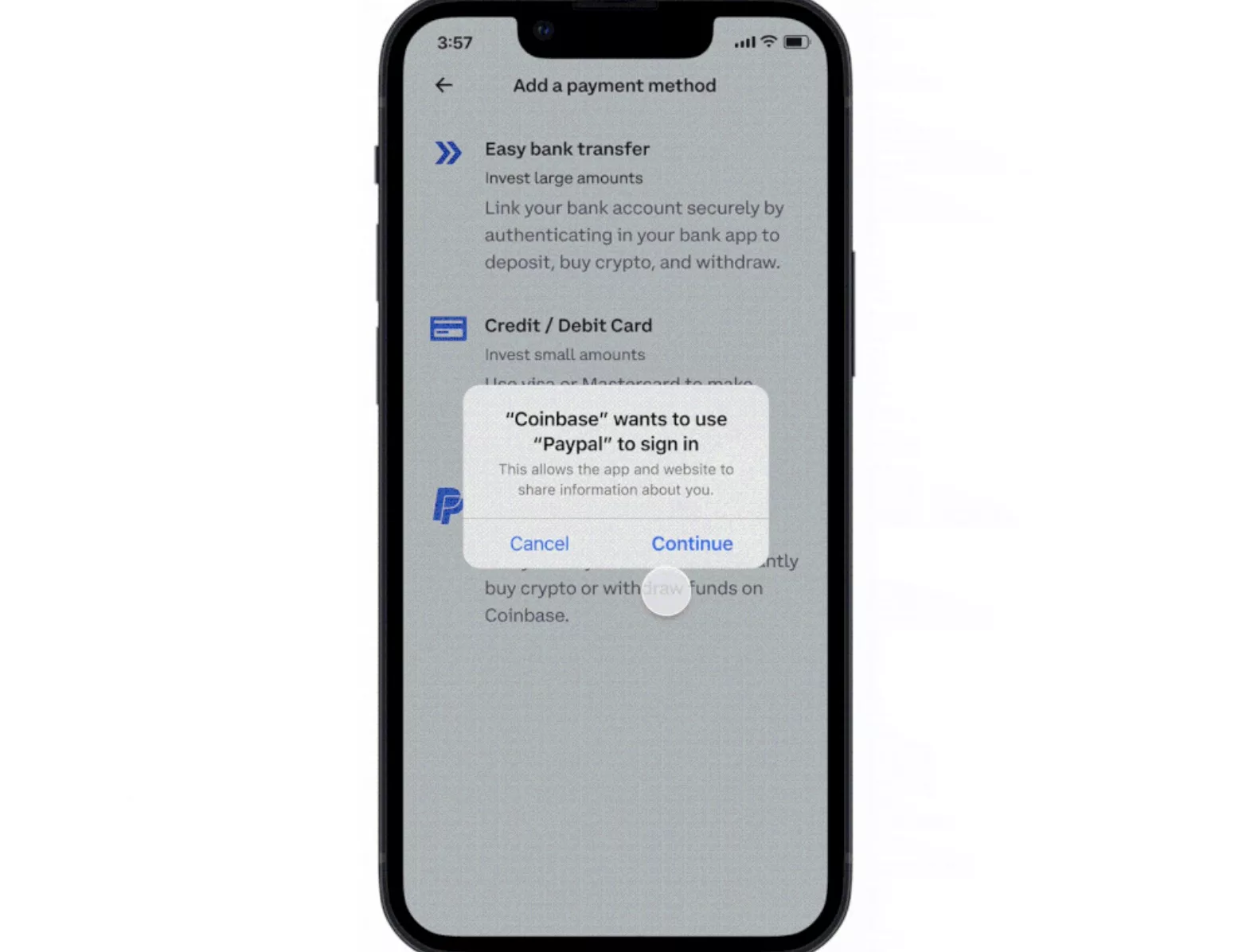

“Coinbase announced on June 30th that it would integrate PayPal as a payment method for users in Australia.”

This partnership brings added convenience by allowing Australian customers to link their PayPal accounts directly to their Coinbase wallets without divulging sensitive financial information. With over nine million active PayPal accounts in Australia alone,”This integration opens up new possibilities by leveraging PayPal’s status as a trusted online payment solution within the country,” Simon Banks , Managing Director of PayPal Australia observed .

The collaboration between Coinbase and PayPal emphasizes innovation aimed at empowering financial choices.“Our aim is to provide Australians with seamless access to all products offered by Coinbase,” Banks remarked . In doing so,

“Coinbase aims not just at strengthening institutional services through acquisitions but also at enhancing retail customer experience through partnerships like this one,” according experts .

These strategic moves underscore how”

Coinbase is strategically positioned both on infrastructural aspects—such as simplifying compliance procedures—and ensuring user accessibility,

” opined industry analysts . As cryptocurrency adoption surges globally,”These initiatives demonstrate how efforts from companies like Coinbase are pivotal in breaking down barriers hindering widespread adoption”, experts affirmed .

By focusing on both institutional requirements through acquisitions like LiquidFi while catering to retail demands via collaborations such as the one with PayPal,”

Coinbase sets itself apart as a comprehensive platform aiming at fostering inclusivity within the crypto ecosystem”, concluded experts .As”Coinbase continues expanding its portfolio through acquisitions complemented by global integrations; it underscores a steadfast commitment toward shaping tomorrow’s digital finance landscape”.

Leave feedback about this