In a recent study by the International Monetary Fund, researchers delved into the data of over a million individuals aged 50 and above across 41 countries. The findings shed light on the sharpness of our brains compared to previous generations. However, it’s crucial to pay attention to subtle changes that may signal the onset of cognitive decline.

“It’s common for individuals to overlook signs of cognitive decline as we tend to avoid negative feelings with thoughts like ‘this won’t happen to me’ and harbor a false sense of superiority believing we can overcome any adversity,”

explained Dr. Smith, a leading neurologist specializing in geriatric care.

One alarming discovery from the research is how financial capabilities diminish amidst cognitive decline. A study conducted in 2020 among Medicare beneficiaries in the U.S., reaffirmed in 2023, revealed that recurring incidents of late payments and credit score drops could precede a dementia diagnosis by up to six years. Shockingly, seniors were found to lose an average of 50% of their savings prior to diagnosis.

“The inability to manage personal finances effectively is often linked with cognitive decline,”

noted Dr. Jones, a financial psychologist.

“Difficulties in using banking services such as ATMs and apps make elderly individuals vulnerable to financial abuse and fraud.”

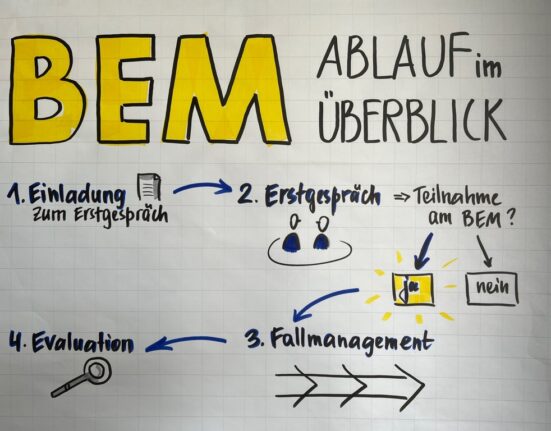

To address this issue, initiatives have emerged aiming to educate financial institutions on handling clients with cognitive impairment. The AARP, representing nearly 40 million American retirees, introduced the BankSafe Dementia Hub—a platform designed to train banks in identifying customers with cognitive decline and establishing protocols for serving them with empathy and security.

According to AARP reports, 84% of finance professionals admitted having at least one client showing signs of dementia while 96% acknowledged feeling unprepared to manage such situations effectively.

“Recognizing early warning signs is vital in safeguarding elderly individuals from financial exploitation,”

emphasized Sarah Brown, a social worker specializing in elder abuse prevention.

Five key indicators should raise concerns:

1. Difficulty handling cash transactions.

2. Prolonged form completion.

3. Repetitive questioning.

4. Regular payment delays.

5. Uncharacteristic contributions or transfers.

Moreover, studies suggest a correlation between depression and dementia among seniors highlighting the importance of holistic care for elderly mental health wellbeing.

Leave feedback about this