Fincra, a prominent player in the African payment infrastructure sector, has achieved a significant milestone by securing a Third Party Payments Provider (TPPP) license in South Africa. This regulatory breakthrough marks a pivotal moment for the company as it gains the authority to process various local payment methods, including debit and credit card transactions, electronic funds transfers (EFTs), real-time clearing (RTC), and rapid payments.

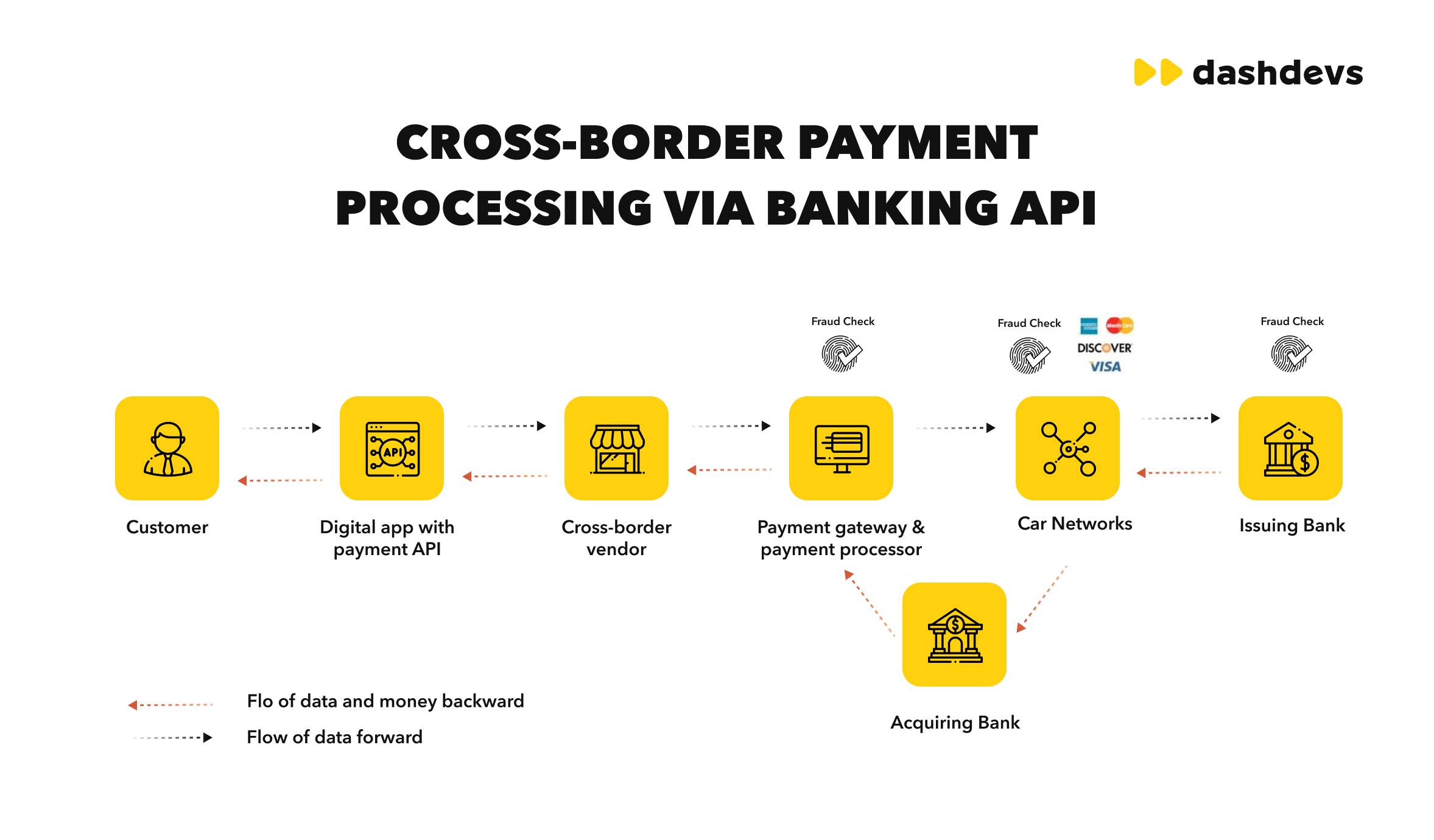

The acquisition of the TPPP license aligns with Fincra’s strategic vision to enhance its cross-border payment network and solidify its footprint in key African markets. By harnessing multiple payment channels, Fincra aims to foster a more interconnected and efficient financial landscape across the continent.

In expressing his enthusiasm about this achievement, Ayowole Ayodele, CEO and Co-founder of Fincra, remarked,

“Securing the TPPP license in South Africa is a significant stride towards fulfilling our mission of laying down the groundwork for an integrated Africa. It underscores our dedication to constructing compliant and dependable infrastructure that facilitates large-scale cross-border trade.”

This latest development empowers Fincra to provide its clientele—comprising e-commerce platforms, logistics firms, B2B marketplaces, and travel agencies—with expedited settlements, heightened reliability, and adherence to South Africa’s rigorous financial regulations. Within the local market arena, Fincra is poised to compete with other fintech startups like Yoco, Ozow, and Peach Payments.

Emmanuel Babalola, Chief Commercial and Growth Officer at Fincra, hailed the licensing as a

“game-changer for enterprises seeking growth opportunities or operational expansion within the region.”

The company’s recent appointment of former Bundle CEO Emmanuel Babalola further reinforces its strategic positioning.

Leveraging robust APIs and forging strategic alliances with Tier-1 banks have been instrumental in Fincra’s journey. These partnerships facilitate businesses globally in collecting payments seamlessly while enabling localized payouts. With operations spanning across Ghana, Kenya,Uganda,the UK,Europe,and North America,Ficnara continues establishing itself as a pivotal force within Africa’s fintech revolution landscape

Leave feedback about this