A venture capital firm, Fluent Ventures, is challenging the notion that groundbreaking startup ideas must originate and thrive in Silicon Valley. Founded in 2023 by Alexandre Lazarow, a former investor at Omidyar Network and Cathay Innovation, the global early-stage fund is on a mission to support entrepreneurs who are replicating successful business models from Western markets in emerging economies.

Geographic Alpha: Replicating Success Across Borders

Lazarow describes Fluent’s strategy as “geographic alpha,” emphasizing that many of the world’s most valuable startups are not entirely novel concepts but rather adaptations of proven models. The firm focuses on sectors like fintech, digital health, and commerce, providing funding ranging from $250,000 to $2 million for startups at various stages of growth.

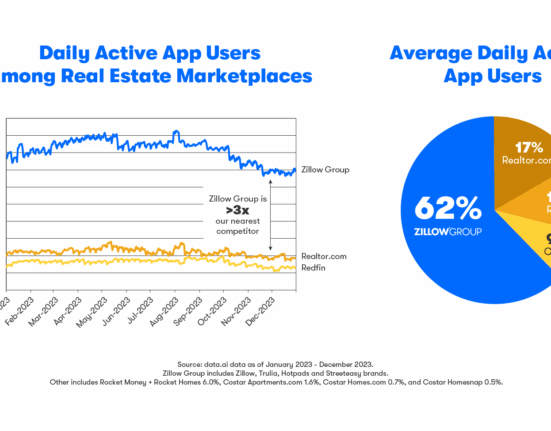

Fluent Ventures acknowledges the changing landscape of the technology industry over the past decade. With more than 150 unicorn companies emerging from cities worldwide compared to just four in 2013, there is a clear trend towards decentralization. This shift has seen successful tech players in emerging markets replicate models that have worked elsewhere, such as e-commerce platforms inspired by Amazon and payment solutions akin to Stripe.

Local Adaptation: The Key to Sustainable Growth

Contrary to being mere copycats, Fluent Ventures prioritizes local adaptation for sustainable growth. An example cited is ride-hailing services; while Uber pioneered the concept globally, companies like Go-Jek in Indonesia localized it by incorporating unique features like motorcycle taxis and super app functionality similar to China’s WeChat.

The firm not only seeks out adapted models but also evaluates factors like local product-market fit and founder-market alignment when making investment decisions. By focusing on regions with high growth potential such as Latin America, MENA (Middle East and North Africa), Africa, Southeast Asia, and select U.S. markets, Fluent aims for deep engagement rather than broad dispersion across geographies.

Redefining Global Success: Exit Markets in Emerging Economies

Despite skepticism about exit opportunities in emerging markets due to rising valuations and increased competition for unicorns’ status compared to a decade ago, Fluent sees momentum building towards successful outcomes. Recent IPOs of startups like Nubank from India and UiPath demonstrate that global success stories can emerge outside traditional tech hubs like the U.S. or Europe.

Fluent Ventures has cultivated a strong network comprising over 75 unicorn founders and venture capitalists who actively support portfolio companies with talent acquisition, fundraising efforts, and expansion strategies. Additionally, strategic partnerships with experienced venture partners bring sector expertise and regional insights into play.

In an era where diversification is key for investors seeking opportunities beyond saturated markets like the U.S. or China , Fluent Ventures offers a unique value proposition centered on tapping into innovation wherever it may arise. By championing entrepreneurship across diverse geographies , the firm aims to redefine conventional notions of startup success while driving meaningful impact on a global scale.

Leave feedback about this