Venture capital in Latin America is a dynamic and ever-evolving landscape, with startups and investors constantly making moves that shape the region’s entrepreneurial ecosystem. In this comprehensive overview, we delve into the latest developments that are making waves across the industry.

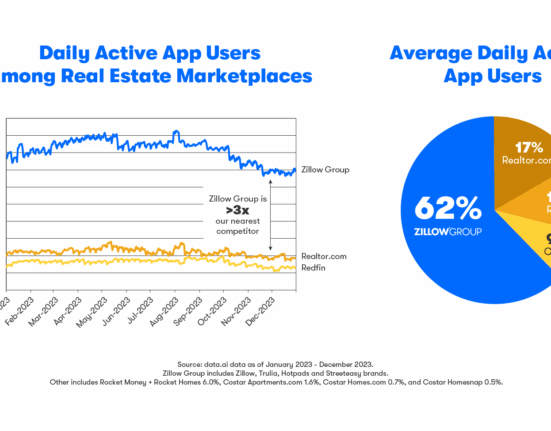

LAVCA Q1 Data Sneak Peek

The first quarter of any year sets the tone for what lies ahead, offering insights into investment trends, emerging sectors, and areas of growth within the startup ecosystem. The LAVCA Q1 data sneak peek provides a glimpse into the performance of venture capital in Latin America during this crucial period.

Expert Insight: “Analyzing Q1 data allows us to identify patterns and anticipate where investor interest is shifting. It gives us a pulse on the market sentiment and helps guide strategic decision-making moving forward.”

Kavak and Merama Updates

Two significant players in Latin America’s tech scene, Kavak and Merama, have been making headlines with their latest updates. Kavak, known for its online marketplace for buying and selling cars, continues to disrupt the automotive industry with innovative solutions. On the other hand, Merama, a rising e-commerce enabler for direct-to-consumer brands, is rapidly expanding its footprint across the region.

With both companies raising substantial funding rounds recently, they are poised to scale their operations further and drive transformation within their respective sectors.

Expert Insight: “Kavak’s success showcases how technology can revolutionize traditional industries like automotive retailing. Meanwhile, Merama’s model empowers DTC brands to thrive in an increasingly digital world.”

Igah Raises Fresh Capital

Igah’s successful fundraising efforts have not gone unnoticed in Latin America’s investment circles. The injection of fresh capital into Igah signals confidence from investors in the company’s vision and potential for growth.

As Igah gears up to expand its presence and enhance its offerings, it exemplifies how startups in the region are attracting significant funding despite economic uncertainties.

Expert Insight: “Igah’s ability to secure new capital underscores investor belief in its value proposition. This influx of funds will enable Igah to execute strategic initiatives and cement its position as a key player in its segment.”

In conclusion, these updates underscore the vibrancy of Latin America’s venture capital arena. As startups continue to innovate and investors show increasing appetite for participation in high-growth markets, the stage is set for further excitement and evolution within the region’s entrepreneurial landscape.

Leave feedback about this