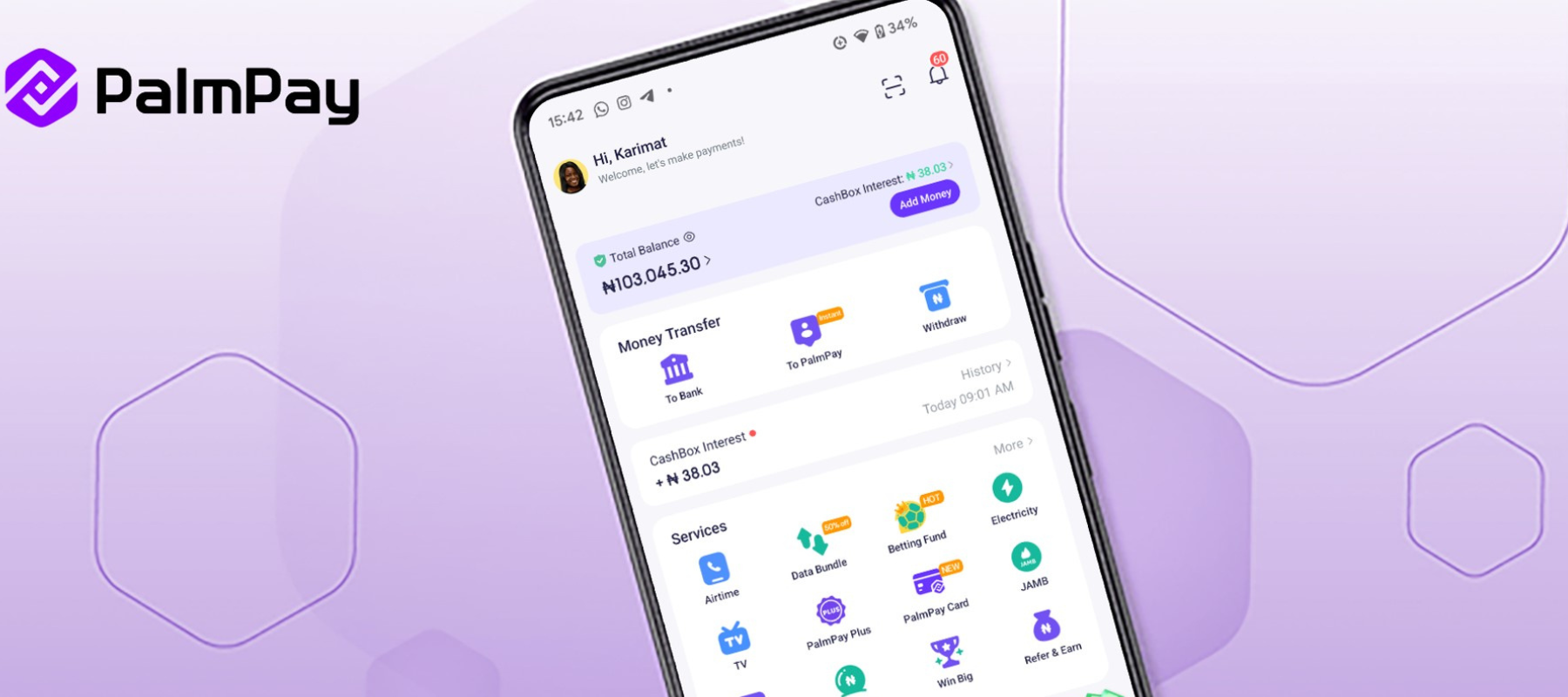

The digital finance scene in Nigeria is witnessing a significant transformation with the emergence of the PalmPay Premium Account. Tailored to offer users greater control over their finances and an enriched banking experience, this exclusive account is reshaping the way individuals interact with digital banking services in the country.

To qualify for the PalmPay Premium Account, users need to maintain a monthly transaction volume of ₦500,000 and a daily account balance of ₦20,000. This elite offering goes beyond just being a status symbol; it brings a host of lifestyle enhancements and financial empowerment benefits that cater to the diverse needs of today’s digitally savvy consumers.

“Cashback rewards are designed to provide users with tangible benefits for their everyday transactions,”

explains a financial analyst.

“By offering up to 3% cashback on purchases such as airtime, data, electricity, and cable TV subscriptions made through the app, PalmPay is incentivizing users to maximize their spending power.”

In addition to cashback incentives, Premium Account holders are entitled to receive 1GB of free data every month. This complimentary data allocation can be used across any mobile network through the PalmPay app, ensuring that users stay connected without incurring additional costs.

“The integration of financial services with lifestyle perks sets PalmPay apart from traditional banking offerings,”

notes a fintech expert.

“By providing daily trial cash rewards deposited into users’ CashBox along with passive earnings that can be spent after accruing interest over five days, PalmPay boosts user engagement and loyalty.”

Moreover, priority customer support ensures that Premium Account holders receive expedited assistance whenever they require help. The VIP-level support underscores PalmPay’s commitment to delivering personalized service tailored to meet each user’s unique needs promptly.

Recognizing the occasional delays in digital transfers, the Fast Transfer Safeguard feature embedded in the Premium Card adds an extra layer of security and convenience for users. In situations where transfers are delayed for more than two hours, customers have access to emergency backup funds via the app, guaranteeing uninterrupted access to their money.

“PalmPay’s higher interest rates on savings products demonstrate its dedication towards helping users grow their wealth efficiently,”

highlights an industry insider. “With an exclusive wealth product offering up to 36% annualized returns and discounts on processing fees for SmartEarn savers, PalmPay is empowering its customers financially.”

Accessing these premium features is straightforward for those who meet the set criteria – maintaining a monthly transaction volume of ₦500,,000 along with a daily balance threshold of ₦20,,000 unlocks an array of benefits associated with upgrading to the PalmPay Premium Account.

In conclusion, by combining financial services innovation with lifestyle rewards tailored towards modern consumer demands, PalmPay continues to redefine digital banking experiences in Nigeria through its distinctive Premium Account offering.

Leave feedback about this