Ever since Donald Trump set the wheels in motion for copper tariffs, the industry has been on edge. The US Commerce Department’s scrutiny into imposing tariffs on copper sent shockwaves through producers and traders alike. With the looming threat of tariffs, the copper market has been in a frenzy.

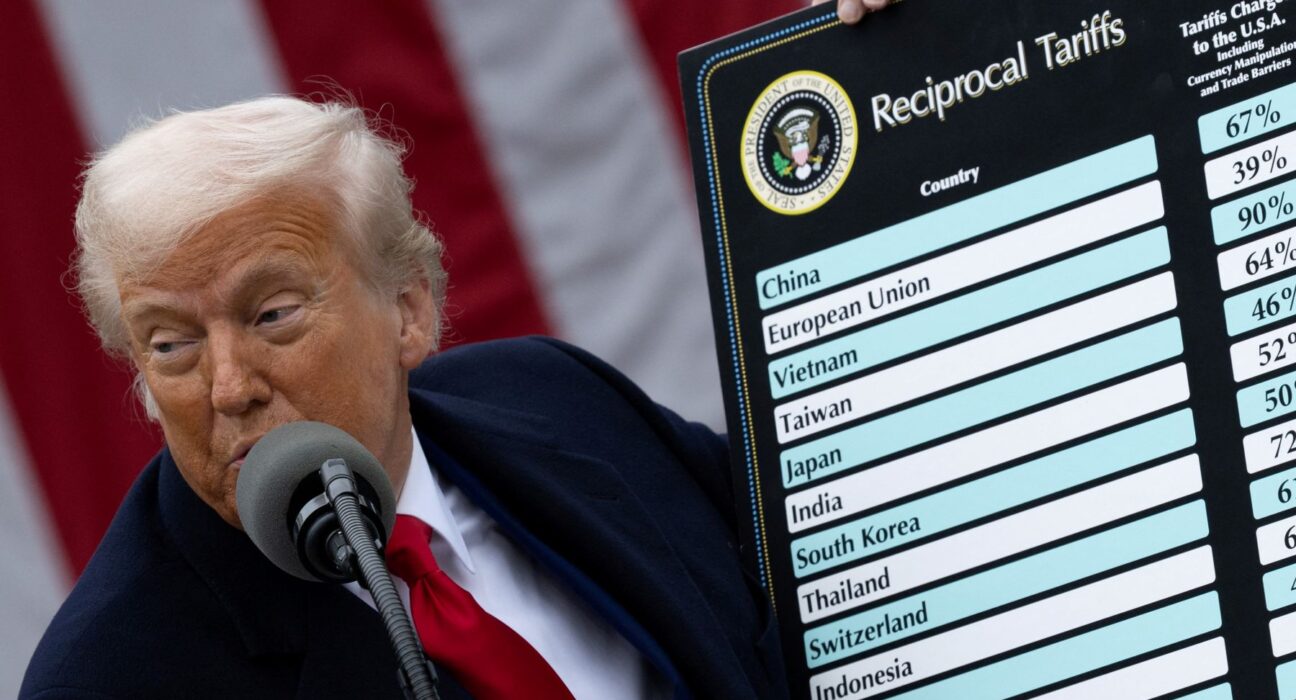

Trump’s plan to slap a hefty 50% tariff on US copper imports caught many by surprise. This move, part of his broader trade strategy, aims to protect national security interests amid growing demand for copper in crucial industries like infrastructure and technology.

“Copper is vital for modern infrastructure and manufacturers,”

said one industry expert.

“Its demand is skyrocketing, especially with the rise of green technologies globally.”

The announcement of the 50% tariff caused a significant stir in the market. Prices surged as traders raced to adjust their positions amidst uncertainty about future supply and costs.

“The sudden tariff imposition has created chaos in the market,”

remarked a seasoned trader.

“It’s not just about higher prices; it’s about securing supply chains and meeting growing demand.”

Despite having substantial untapped copper reserves domestically, the US faces challenges in ramping up production due to regulatory hurdles and limited processing capacity.

“Building new smelters in the US is no easy feat,”

explained a mining analyst. “It takes time, massive investments, and stringent environmental considerations.”

While increased domestic production could mitigate supply risks, competing with established Chinese smelting giants poses a daunting challenge for American producers.

“The dominance of Chinese smelters presents a formidable competition,” noted an industry insider. “US manufacturers would struggle to match China’s cost efficiency and scale.”

The ripple effects of Trump’s tariff extend beyond higher prices for raw copper. Downstream industries reliant on copper products will feel the pinch as costs soar across the board.

“Manufacturers using copper will face tough choices ahead,” highlighted an economic analyst. “Higher costs could erode competitiveness and push up consumer prices.”

As uncertainties loom over global trade dynamics, businesses are bracing for potential disruptions that could reverberate throughout the economy.

“The tariff escalation adds another layer of complexity to an already volatile market environment,” observed a financial consultant. “Adapting to these changes will be crucial for businesses to stay afloat.”

With mounting pressure on supply chains and pricing structures, stakeholders are closely monitoring developments as they navigate turbulent waters in this evolving trade landscape.

In conclusion, Trump’s bold stance on copper tariffs underscores the intricate web that ties global markets together – where decisions made at one end can send shockwaves across continents.