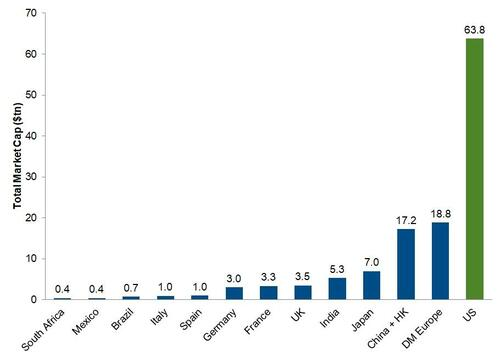

In a groundbreaking development, the U.S.

Stock Market has surpassed the combined market capitalization of major economies including Europe, China, Hong Kong, Japan, India, and several European nations.

This astonishing feat highlights the dominance of the American financial sector on the global stage, defying expectations of American Exceptionalism’s demise..

The surge in the U.S.

Stock Market’s market cap underscores the resilience and strength of the American economy, positioning it as a formidable force in the international financial landscape.

This milestone not only showcases the robustness of American businesses and investors but also reflects the confidence and stability that the market offers amidst global uncertainties..

South American nations such as Brazil, Argentina, Colombia, and Chile are closely observing this development, recognizing the implications it may have on their own economies and markets.

As the U.S.

Stock Market continues to outpace major economic regions, South American countries may seek to enhance their competitiveness and attract more investment to bolster their own financial markets..

The implications of the U.S.

Stock Market’s surpassing of combined market caps are significant, signaling a shift in global economic dynamics and potentially influencing investment flows worldwide.

South American nations may now face increased competition for capital as investors may be drawn to the allure of the U.S.

market’s size and stability.

This development underscores the need for South American countries to focus on strengthening their economies and markets to remain attractive in the eyes of global investors..