Gemini, a digital assets exchange, has recently unveiled an exciting development that brings together traditional finance and decentralized finance. The company announced a groundbreaking release on July 3, 2025, introducing a fresh selection of tokenized stocks tailored for European Union investors.

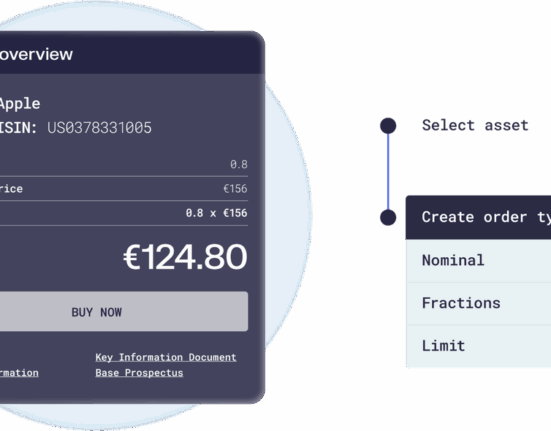

These innovative tokenized stocks represent a significant advancement in the financial world by allowing EU investors to trade fractional shares of prominent U.S. companies without the constraints of traditional brokerage accounts. This move is part of Gemini’s broader initiative to democratize access to U.S. equities through blockchain technology.

The tokenized stocks are issued on the Arbitrum blockchain in collaboration with Dinari, a FINRA-registered broker-dealer. This partnership ensures regulatory compliance and liquidity for the tokens by backing them with real securities. By leveraging blockchain’s transparency and instant settlement features, Gemini offers EU investors seamless trading opportunities across various U.S. companies 24/7.

Incorporating renowned names such as Tesla, NVIDIA, Apple, Amazon, Microsoft, and more into its offerings demonstrates Gemini’s strategic approach in blending stability from traditional blue-chip companies with innovation from crypto-related firms. As highlighted during Gemini’s recent “List-a-Thon” livestream event, this diverse portfolio caters to both crypto-savvy individuals seeking exposure to digital assets like Bitcoin and traditional investors looking for established high-value assets.

The inclusion of Exchange-Traded Funds (ETFs) such as SPDR S&P 500 ETF (SPY) further enriches the array of tokenized assets available to investors by providing an avenue for broad market exposure through a single asset class.

One key aspect that sets Gemini apart is its utilization of Arbitrum, an Ethereum Layer-2 network that enhances transaction speed while reducing costs compared to conventional stock exchanges. This aligns with the ethos of DeFi by delivering efficiency and accessibility to users.

With plans to extend its tokenized stock trading services onto additional blockchain networks in the future, Gemini aims to enhance interoperability and expand accessibility for global investors interested in this emerging asset class.

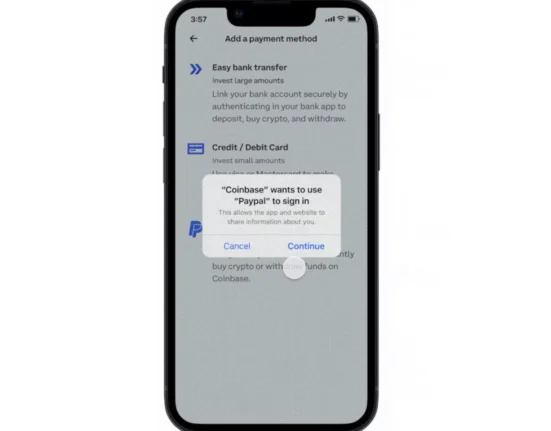

As expert analysts predict a substantial growth trajectory for real-world asset (RWA) tokenization—forecasted to reach a $4 trillion market value by 2030—players like Coinbase and Kraken are also exploring similar avenues beyond US borders. However, jurisdictional disparities pose challenges as stringent regulations may hinder wider adoption globally.

While offering advantages such as fractional ownership and improved trading experiences,Gemini cautions investors about potential risks associated with tokenized stocks mirroring those seen in traditional equities markets—including price volatility influenced by various factors like market sentiment and geopolitical events.

Gemini applies a fee of 1.49% on trades involving tokenized stocks while recommending that investors seek guidance from tax advisors regarding any capital gains or income tax implications arising from their activities within this domain.

By expanding into the realm of tokenizing stocks,Gemini solidifies its position as a pivotal player bridging TradFi principles with DeFi innovations.This move not only provides EU investors with modern gateways into U.S.equities but also underscores Gemini’s commitment toward reshaping global finance through security-compliant practices infused with innovation.

Leave feedback about this